ADVANCED TRAILING STOP

Introduction

Why have I developed this?

ATR Multiples

Trade Stages

Examples

FAQ

Disclaimer

Downloads

INTRODUCTION

The Advanced Trailing Stop, based on the Chandelier

Exit developed by Chuck

Le Beau, is volatility-based. Dr. Van K. Tharp in his book Trade

your way to Financial Freedom says "volatility stops are

among the best stops you could select". I've been using the volatility

stop technique for a few years now.

Using the Metastock Developer's

Kit, I developed a I developed a Metastock

DLL because

the Metastock

Formula Language lacked a simple way of referencing prices

from the entry day of the trade. If you just want to download

the

DLL, scroll to the bottom of this page.

Many

traders set stops according to a fixed % movement. However,

the % method needs to be adjusted according to the volatility

of

the security being traded.

Using a volatility based stop means that your stop automatically takes account

of

the security's volatility.

For example, if the security has a high volatility,

your stops will be a reasonable distance away from the price

action (to give the security room to move in its normal intraday

movements). If a security has a low volatility then the stop

will be relatively closer to the price action. If the security's

volatility changes whilst a trade is underway, the stops will

adjust according to this volatility. The advantage to this type

of stop is that it can be used in any market (blue chip stocks, speculative

stocks, futures, index trading, mutual funds etc.)

The Advanced Trailing Stop has the following

components:

- Initial Stop, expressed in terms to the entry day

(eg. Closing price less 2 ATRs)

- Trailing Profit stop, calculated on each bar of the day after

entry (eg. High less 3.5 ATRs)

Optionally, you can also incorporate the following types of

stops:

- Breakeven stop - this is calculated on the entry day and is

implemented when the stock passes a "transition point".

(eg. Move my initial stop to a breakeven stop when the price

closes

2 ATRs above my entry price). I believe this transition/breakeven

stop was part of the original Turtles trading technique.

- Pyramid Points/Tightening Stops - the Trailing Profit Stop

can be recalculated when the stock passes further transition

points. I have defined two such points. (eg. When the stock moves

more than 4 ATRs above my entry price, change to a trailing profit

stop that is the High less 3 ATRs. If it reaches 6 ATRs above

my entry price, change to a trailing profit stop that is the

high less 2.5 ATRs). Chuck Le Beau talks about this tightening

of the stops in his original newsletter.

If any of your stops are hit, the Stop Loss line will continue

to be drawn across the screen. This is good for your psychologically if

you can't get out of a trade. It'll keep telling you to get out! The line

will not trail the price any further (it will be flat) just to re-emphasise

that you should be out of the trade.

WHY HAVE I DEVELOPED THIS?

It's something I use in my own personal trading. Developing in Visual

C++ with the Metastock Developer's Kit is something very few people

have the

skills to perform and I thought I'd give something back to the rest of

the trading community. Perhaps you'll also consider subscribing to Premium

Data if you want reliable end-of-day data.

I do not intend to ever commercialise this plugin - I'm happy for

anybody and everybody to use it for free.

ATR MULTIPLES

By using logical values for the ATR multiples, you can define your trading

style. For short-term trading, a trailing profit stop of 2 - 2.5 ATRs is useful.

For medium-long term trading, a trailing profit stop of 3-4 ATRs is useful.

TRADE STAGES

The Advanced Stop system also allows you to plot a binary indicator

that will indicate which "stage" of the trade you're on (very

useful if you want to create an expert advisor).

The stages are:

0 - Not in a trade

1 - In trade, current stop being used is initial stop, trade

is still underneath transition point to breakeven stop.

2 - In trade, trailing

profit stop used

3 - In trade, price is past first pyramid point

4 - In trade, price is past second pyramid point

-1 - Trade stopped out on initial stop

-2 - Trade stopped out on trailing profit stop (or breakeven

stop if this is being used)

-3 - Trade stopped out on first pyramid trailing profit stop

-4 - Trade stopped out on second pyramid trailing profit stop.

This trade stage system is also fantastic if you are developing

trading systems with very specific defined entry points.

Check out the StageLong and StageShort functions.

EXAMPLES

The following examples are produced from Metastock v8, using

stock and futures data

from Premium Data.

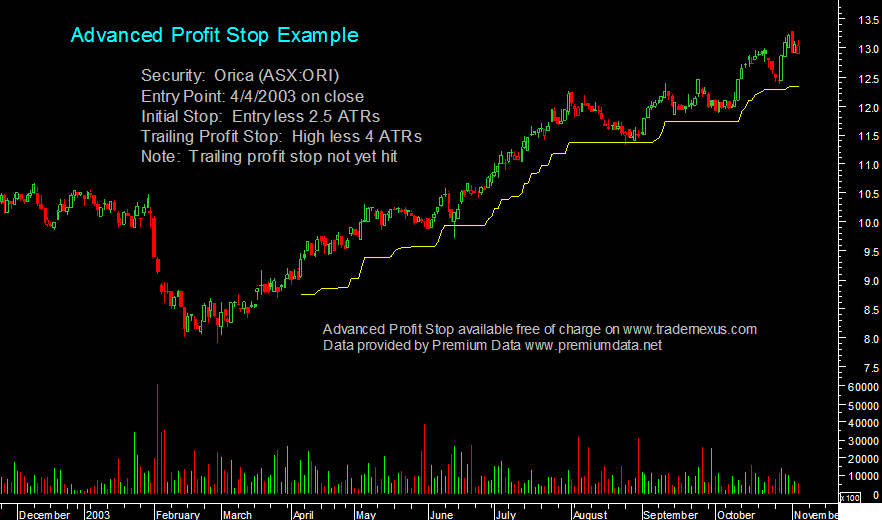

Chart below shows standard trailing profit stop:

Chart below shows trailing profit stop on same stock but with

a different trailing profit

stop ATR multiple.

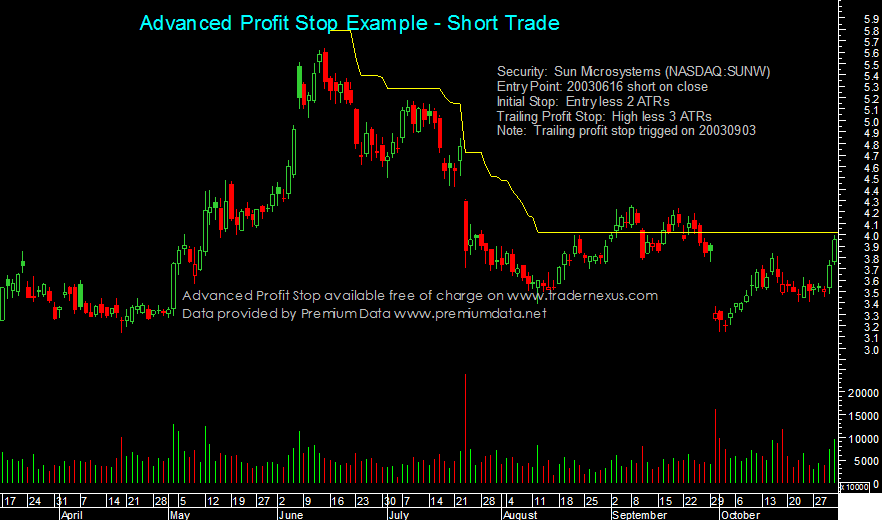

This chart shows the trailing profit stop on a short trade.

The chart below shows Crude Oil:

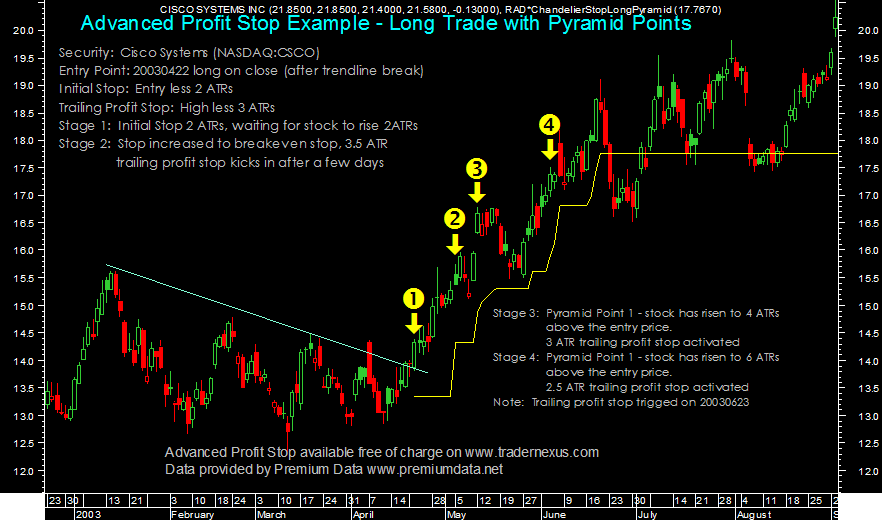

This chart shows Cisco on a long trade using the more advanced

Pyramid tightening stops.

Note: I manually drew in the points marked 1, 2, 3 & 4, to show

the pyramid points a little better for you.

USAGE

After installation, a DLL file called AdvancedStop is stored

in your equis\metastock\external formula dlls directory. The

Advanced Stop DLL has four functions that can be called:

StopLong - the trailing profit stop on a long trade

StopShort - the trailing profit stop on a short trade

StageLong - the stage of the trade in a long trade

StageShort - the

stage of the trade in a short trade

All of the above functions take the following parameters:

Entry Condition - what causes an entry (eg. a particular date,

moving average crossover etc.)

Initial Stop

at Entry - The stop point when you enter the trade

Transition to breakeven stop - The price at which you transition

to a breakeven point (calculated on day of entry) - set this to

0

if you do not want to use a breakeven stop.

Trailing Profit Stop - The value of the trailing profit stop, calculated

on each day of the trade.

First Pyramid Condition - The price at which you transition to

the first pyramid condition (calculated on day of entry). Set this

to 0 if you do not want to use a pyramid

Trailing Profit Stop at First Pyramid - The value of the trailing

profit stop, calculated on each day of the trade, after the first

pyramid point has been signalled. Set to 0 if you do not want to

use this.

Second Pyramid Condition - The price at which you transition to

the first pyramid condition (calculated on day of entry). Set this

to 0 if you do not want to use a pyramid

Trailing Profit Stop at Second Pyramid - The value of the trailing profit stop,

calculated on each day of the trade, after the second pyramid point has been

signalled.

Set to 0 if you do not want to use this.

All of the above seems complex at first

sight! Luckily I've provided a few formulas that help you to plot the above

on a chart.

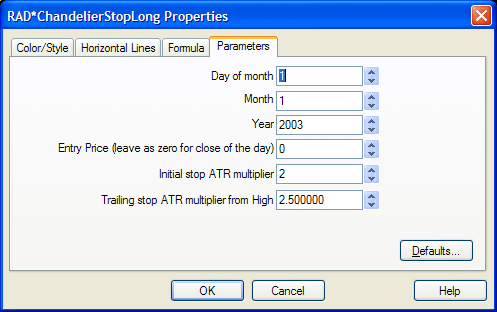

USAGE EXAMPLE - PLOT A TRAILING PROFIT STOP FROM A GIVEN DAY ONWARDS

entryday:=Input("Day of month",1,31,1);

entrymonth:=Input("Month",1,12,1);

entryyear:=Input("Year",1800,2020,2003);

entryprice:=Input("Entry Price (leave as zero for close

of the day)",0,5000,0);

entryprice2 := If(entryprice>0,entryprice,C);

initatr:=Input("Initial stop ATR multiplier",0.1,6,2);

trailatr:=Input("Trailing stop ATR multiplier from High",0.1,6,2.5);

entryfulldate

:= (entryyear)+(entrymonth/12)+(entryday/365);

fulldate := Year()+Month()/12+DayOfMonth()/365;

entry:= entryfulldate > Ref(fulldate,-1) AND entryfulldate <=

fulldate;

ExtFml( "AdvancedStop.StopLong", entry,entryprice2-initatr*ATR(10),0,H-trailatr*ATR(10),0,0,0,0);

Using the above code in a formula allows me to drag a simple

indicator on to the price chart, in much the same ways as you

put a moving average on the chart.

After dragging the indicator on to the chart, you will see:

So, all you do is enter in the date you entered the trade, the

price you entered (or 0 for the closing price) and the two multipliers

for the initial stop and trailing stop. After this, the trailing

stop will be plotted on your price chart just like the examples

above.

I have included a few more indicators that can be dragged onto

the chart too - check out the code inside them for further details.

Trick used above: You'll notice I have some code in there to

calculate dates etc. I have used a little trick that allows the

trailing profit stop line to still be plotted even if you put

in an invalid date (eg. weekend). If I didn't use this, and an

invalid date was given, you'd have an 'invisible' indicator which

is rather difficult to remove from your chart.

FREQUENTLY ASKED QUESTIONS

What trailing stop values/multipliers should I use for trading <XYZ>?

The beauty of the above DLL is that you can try out different multiples

to suit your personal style of trading. Aggressive short-term

traders will generally use low multiples and longer-term traders

will use high multiples.

What entry conditions should I use?

Use the entry conditions contained within your written trading plan.

This Metastock Plugin is used for exits not for entries!

I used your trailing stop and it lost me money.

Firstly: I'll happily refund the money you paid me for the Advanced Trailing

Stop. Oh, that's right, you didn't pay anything.

Secondly: Grow up. Take responsibility for your own trading decisions.

Do not use something you don't fully understand. This is just a tool to

assist traders, not tell them what to do.

Thirdly: You must not have read the disclaimer below and when you

installed the plugin.

Are any of the indicators password protected?

None of indicators are password protected - you may edit and modify it

to suit your trading style.

I have a stop loss methodology that doesn't use ATRs. Can I use

this DLL to assist me?

Most certainly you can. The entire system is based on two types of

conditions - (a) conditions relative to the entry price (initial

stop & pyramid points) and (b) conditions relative to the

current day's price (trailing stops). These do not need to

be ATR based.

Send your questions to: advancedstop@tradernexus.com

KNOWN LIMITATIONS

Doesn't plot in the first few bars of a chart. For new IPOs etc. you will

need to wait until the ATR has valid values (eg. 10 day ATR requires 10 days

of chart information first).

Perhaps not a limitation - Intraday price movements are ignored. Therefore

if the close of the day doesn't go past your stop, it still considers that

you are in the trade.

FEEDBACK

I'm interested in your feedback. Let me know what you think of this Metastock add-in at

DISCLAIMER

In this day and age of litigation, everybody wants to blame someone else

when things don't go to plan.

Richard Dale nor any associate

of his, is not permitted to provide personal securities recommendations. Therefore

anything

that is either spoken, shown or implied within this web site, any downloaded

files, any links to other sites or communication related to this site will

not be taken as an investment recommendations or advice.

Before making an investment decision on the basis of any information received

from this web site or subsequent communications with Richard Dale or his associates,

I will consider with or without the assistance of a licensed securities adviser,

whether my application of the information is appropriate in light of my particular

investment needs, objectives and financial circumstances.

I understand and agree that Richard Dale nor any associate of his,

shall in no way be liable to myself or anyone else for any loss or injury

caused in whole or in part through any activity related to this web site.

In short, I guarantee that you will lose money in the market. If you do not

lose money in the market as a result of this web site or any tools that are

provided then give some of it to a charity.

DOWNLOADS

Before you download, read the disclaimer above. You may only

download the following files if you agree to the disclaimer.

Now choose which version of Metastock you own:

AdvancedTrailingStop v1.1 for Metastock

v8.X or v9.X or v10.x (156K download)

AdvancedTrailingStop v1.1 for Metastock v7.X (155K download)

Note: I have been advised that AVG Antivirus 6.0.777 (Free Edition) with Virus Database 524 (Release date 14/10/2004) reports the above files as

containing a "Trojan Horse PSW.Bancban.2.1". The above files do NOT contain any trojan horse/spyware/viruses. If you see this error message, disable AVG while you're installing the plugin and turn it back on again aftewards.

Also, I recommend you contact Grisoft so they can fix their antivirus definitions.

The above files will automatically install the AdvancedStop

DLL into Metastock, along with the following Indicators:

RAD*ChanderlierStopLong

RAD*ChanderlierStopLongPyramid

RAD*ChanderlierStopLongWithTransition

RAD*ChanderlierStopShort

RAD*ChanderlierStopShortPyramid

RAD*ChanderlierStopShortWithTransition

MetaStock is a registered trademark of Equis International